Table of Content

- Deduction under Section 24 is also available to buyers who do not use home loan

- Can I claim deduction of principal repayment on home loan under Section 80EEA?

- Can I claim deduction under Section 80EEA if loan was taken in 2015?

- What should be the source of the home loan for Section 80EEA to apply?

- What is the deduction for under Section 80EEA?

- Income Tax Benefits On Multiple Properties & Income Tax Benefit On Second Home Loan

- List Of Documents Required For A Home Loan In 2022-23

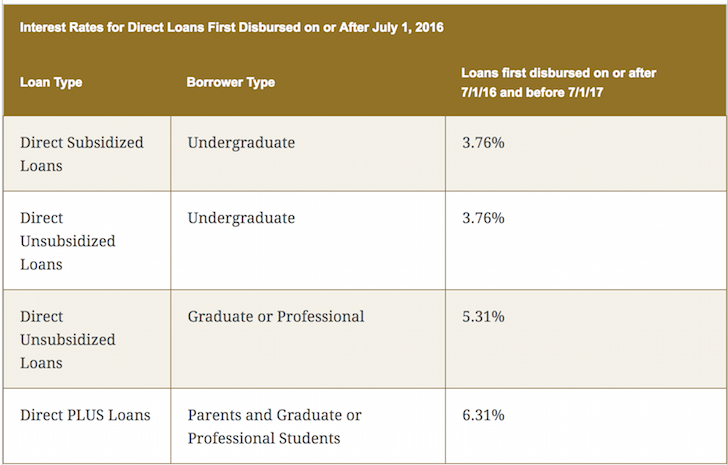

The loan amount is less than 35,00,000 and the loan was sanctioned between 1-April 2016 – 31-March 2017. You can claim the deduction for interest paid u/s 24 for improvement in house property. Balance interest can be claimed in income from house property by showing it as a deduction. You have rightly mentioned that from AY , loss from house property allowed to be set off from other income is limited to 2,00,000rs.

So you will not be able to claim the benefit of Rs 2 Lakhs for this. Yes, In the case of Joint Owners each owner can claim 80C and 24 deductions for the financial year to the extent of their share in the property. The act of paying out money for any kind of transaction is known as disbursement. From a lending perspective this usual implies the transfer of the loan amount to the borrower. It may cover paying to operate a business, dividend payments, cash outflow etc. So if disbursements are more than revenues, then cash flow of an entity is negative, and may indicate possible insolvency.

Deduction under Section 24 is also available to buyers who do not use home loan

The following grid highlights the sections of the Income Tax Act that provide home loan rebate to the borrowers. If you sell your house within 5 years after possession, any deduction claimed will be reversed in the year in which you sell it. This amount will also be added to your income for the year of sale.

The value of the house property at the time of loan approval must not exceed Rs 50 lakhs. Home loan interest rebate in income tax can be claimed for both self-occupied as well as let out property. Loan against property tax benefit/mortgage loan tax benefit.

Can I claim deduction of principal repayment on home loan under Section 80EEA?

Under this section, you can claim a maximum deduction up to Rs 50,000. If the construction is not completed within 5 years the interest exemption is restricted to Rs.30,000/- per year. To claim it, you need to complete the construction of the property first. While there were no major changes regarding the deductions under home loans, the only major news worth noting was the allocation of Rs.48,000 crore to the Pradhan Mantri Awas Yojana .

Only interest amount paid on housing loan is allowed as deduction u/s 80EE. You can claim a deduction for each home loan separately, it will not be clubbed and allowed from only one single house property. Interest prior to the possession of house property has to be claimed in five equal instalments beginning from the F.Y. I am first-time house buyer and did not have any property on the date of sanction of loan.

Can I claim deduction under Section 80EEA if loan was taken in 2015?

The total income tax deduction that can be availed would now be up to Rs.7 lakh for this time period. First-time home buyers can claim tax deduction of Rs 1.50 lakhs in a year against the home loan interest payment under this Section. The Government of India extends these benefits as a form of relief to borrowers, making home purchase more affordable. On availing a home loan, you need to make monthly repayment in the form of EMIs, which include two primary components – the principal amount and interest payable.

This is for the first time I am taking a home loan & I do not have any other property under my name. The assessee does not own any residential house property on the date of sanction of loan. You are not eligible to claim deduction u/s 80D as the proposer of the insurance is your brother. I had purchased the shop in 2017 with a loan from financial company & I had already owned a house in my name so shall I have taken exemption in the Income tax return for Interest & Principal amount on Loan.

What should be the source of the home loan for Section 80EEA to apply?

Under specific circumstances, where the lender finances such an insurance plan and the borrower repays via loan EMIs, deductions are not allowed. If you take a second home loan to purchase another property, tax benefits are applicable on the interest paid. Here, you can claim the entire interest amount paid as no cap is applied. The buyer claims tax deduction towards interest payment, only after the completion of construction.

As per Section 24, a person can deduct amounts up to Rs 2 lakh an income tax rebate on home loan from their overall revenue for the interest element of an EMI you paid throughout the year. There are numerous Income tax rebate on home loan that come with home loans when you purchase a property and drastically lower your tax bill. Both Interest payments and principal are part of a loan. Premium My wife and I have availed a single joint housing loan for our self occupied house. In the new tax regime, you can’t claim exemption on the interest paid towards Home Loan for self-occupied property under section 24.

Section 24 also allows buyers to avail of deductions, even if the buyer has used fund from his own sources to make the purchase, without seeking any home loan. Under the section, a flat 30% deduction on the net annual value of a property is available to the owner, if the house is purchased entirely using the buyer’s personal funds. However, this rebate will not be available if the property is self-occupied, since such properties do n0t have any net annual value under the existing tax laws. If you have taken loan to build a home, the construction work should be completed within 5 years of taking the home loan.2. The house should not be sold within 5 years of possession. In case that happens, any deductions that you have claimed will be added back to your income and taxed accordingly, in the assessment year in which the sale takes place.3.

It is allowed in 5 equal installments beginning from the financial year in which the construction is completed. The limit of 2 lacs will also apply for pre-construction interest in the case of self-occupied property. Section 80EE of the income tax allows you to claim a tax rebate on the interest payment of the home loan availed to buy a house property. No under construction home loan tax benefits under section 80C for principal repayment of the loan. Given below are the prerequisites to avail this additional benefit of 80EEA income tax. Section 80EEA does not specify if the property must be self-occupied, to seek the tax break.

The Principal portion of the home loan paid for the year is allowed as a deduction under Section 80C. The maximum amount that can be claimed is up to Rs 1.5 lakh. But to claim this deduction, the house property should not be sold within 5 years of possession. You can claim additional deduction u/s 80EEA for maximum up to Rs 1,50,000. To claim this deduction, the stamp value of the property does not exceed Rs 45 lakhs and loan must have been sanctioned between 1 April 2019 to 31 March 2020. Are there any other tax deductions I can claim with respect to interest payment on the home other than the interest under Section 24? You can also claim tax deductions in respect of the interest on the housing loan under Section 80EE of the Income Tax Act.

No comments:

Post a Comment